BuySilverMalaysia.com is a startup company based in Selangor specializing in trading Gold and Silver bullion. Our sales volume has reached RM1.95 million from Aug to Nov 2013.

One of the main factors contributing to our success is the ease and convenience for our clients to effect payment. We offer Interbank GIRO (IBG) transfers with direct intrabank transfer (fund transfers within the same bank) for up to 6 local banks as well as credit card payment through iPay88 and PayPal. This ensures a hassle free and secure payment solution for our clients.

This may come as a surprise, but bank transfer option takes 96.52% of the sales amount. The remaining 3.48% is shared by credit card payment through iPay88 (1.25%) and PayPal (2.23%) respectively. Of the 96.52% bank transfer pie, Maybank commands the highest volume with the lion share of 67.70%. Second place is Public Bank with 11.27% while third in line is CIMB with 9.61%.

Putting this from another perspective, for every 100 orders BuySilverMalaysia.com acquires, 96 of them are paid in cash through bank transfers. This rather contradicts with the recent popular online payment methods research done by ecommerce.milo, which suggested 50% of Malaysian online shoppers prefer paying through online banking facilities.

Why is that so? Customers prefers credit card due to its credit facilities and reward points. For many businesses, PayPal is their preferred choice due to its seller protection facility.

However, for BuySilverMalaysia.com, we have successfully advocated bank transfers as the preferred payment solution.

Surprised? Let us share with you the reason why.

Read also: Do top e-commerce websites in Malaysia fancy cash bank-in (bank transfer)?

5 reasons why Direct Bank Transfer is a better advantage

Reason #1: Cash is King

In today’s businesses, especially for low margin industries, cash is always King. The sooner your business is able recoup its capital, the faster you can utilize it for the next business cycle.

This is called velocity of funds.

In commoditized industry such as computers, electronics and mobile phones, it is no longer about the retail margin you make from selling the product. More often, it is about how many times you complete a transaction cycle and making the spread.

Having control over your business capital is a crucial key for success.

Bank transfer is the best option to get payment because you get to use the capital the moment it reaches you. You have control over it directly.

Reason #2: Speed is Queen

Payments via IBG transfer can reach your account as fast as within the same day while intrabank transfer updates your account immediately. No other payment solutions are able to beat this neck breaking speed.

In comparison, by setting up an enterprise account with iPay88, the quickest you can receive your fund is T+1 working day (T is the day the transaction made). If you are operating a smaller business with smaller volume, this can take from 7 days up to a month before the fund reaches you.

Read also: Why the RM900 Fee Hike for iPay88 & MOLPay?

Not only direct bank transfer is the fastest payment option, they work every day, including public holidays.

Reason #3: Lowest Possible Processing Fee

Bank transfer has the lowest cost for payment. It is so low, it is next to zero.

IBG transfer cost RM0.10 per transaction. Intrabank transfer is absolutely ZERO cost.

Although bank transfers have a daily limit of RM10,000.00 per account, there is a simple solution for this. Our clients can either remit the balance from another bank, or to transfer the balance the next day.

In contrast, note the below processing fees for credit card and merchant payment options in Malaysia:

iPay88.com’s credit card processing fee costs between 2.5% and 4% per transaction. (source)

Entry level merchant for PayPal starts with 3.9% + RM2.00 per transaction. (source)

Read also: PayPal Country Manager, Audrey Ottevanger's response on recent price hike

Reason #4: No Chargeback Risk

Many merchants are unaware that payments made via credit card or PayPal are exposed to 6 months chargeback risk. Your customers have 6 months to call Visa, MasterCard or PayPal to file a chargeback case against you and your company – especially if you are sending phony products to your customers.

However for a genuine business, chargeback can actually backfire on you. This is when the “victim” is the fraudster. The common crime ranges from using stolen credit card or PayPal account for transaction to intentional business sabotage. They could even simply claim they did not receive your goods when in actual fact they already did.

Read also: Malaysia ranks #7 in the world's most fraudulent countries

An investigation will be lodged and your merchant and even bank account might be frozen. In worst case scenario, payments are deducted and your account is blacklisted. Hence like it or not, to clear your name you must cooperate with the investigation. This spells extra work and unwanted hassle.

Regardless of the outcome, it is a horrible situation you do not want to engage in. Some merchants we know had lost hair over this.

Understanding more on Chargeback: Chargeback Guidelines for Merchants, MasterCards Chargeback Guide, Paypal Chargeback Guide.

Once payment is effected through bank transfer, the payment cycle is over and completed. You get good night sleep because the money now sits firmly in your bank account.

Reason #5: Lower Price Tags

You can save as much as 4% off your retail price by skipping the credit card processing. By channeling back this savings as a rebate, your clients will naturally be delighted (who doesn’t like rebates?). You will be their first choice to recommend to their peers.

Alternatively, you can pocket this without anyone knowing.

Either way, it is a sweet position to be in.

There is truth in the old saying that goes like this: A penny saved is a penny earned.

How BuySilverMalaysia.com does it?

We believe by now you will agree that payments via bank transfer is an advantageous solution to the seller. To encourage clients to pay via bank transfer, we implemented 6 strategies which we welcome you to try as well.

Strategy #1: Everybody Loves Rebates

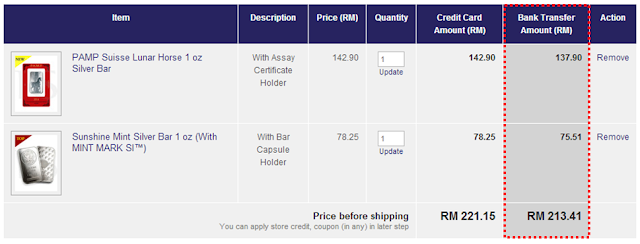

While it is common practice to add surcharges for credit card payment, we did otherwise. Instead, we include credit card processing fee into our price tags. On check out, customers have the option choose their desired payment option.

If they choose to pay via iPay88 (credit cards) or PayPal, full amount will be displayed, which includes credit card processing fee. Nothing happens to the final amount.

|

| Offer customer rebate if pay using bank transfer instead of credit card |

However, if customers decide to pay by bank transfer, immediate 3.5% deduction from the retail price will be reflected on their total final amount. This directly creates an illusion of “rebates”.

It is hard to resist immediate discount because everybody just loves rebates!

Strategy #2: Numbers Speak By Itself

Our subconscious mind is hardwired to pay as low as possible in any situation. We display prices of credit card and bank transfer payment clearly in product catalogue and shopping cart page. Customers are more willing to pay by bank transfer once they have visual on price differences – especially on savings!

Once they see it, it is difficult not to get influenced.

Strategy #3: Play the Good Guy Card

Because rebates are rare in our market, we receive bucket load of queries about it frequently. We explained to them the reasons clearly:

“We do not earn extra from the processing fee imposed by credit cards companies or PayPal. The money goes to pay them [Visa, Mastercard and PayPal]. By opting for bank transfer, we save the processing fee. Savings saved is channel back to you directly as rebate. We know it takes extra steps to pay by using bank transfer but it is worth it.”

We became the good guys instantly and thus, another long lasting client-seller relationship begins!

Strategy #4: Offer Popular Banks

We have 6 bank accounts to reduce risk and at the same time also providing intrabank transfer convenience. The bank list includes Maybank, Public Bank, CIMB, HSBC, RHB and Alliance Bank. We recommend you to have 5 or more banks for you clients to choose. At minimum, your bank list must include Maybank, Public Bank and CIMB because these 3 banks have the highest depositors in Malaysia.

Read also: What are the most popular credit cards for online payment?

It is unwise to rely on just one bank for payment. Your business will be seriously affected if unexpected downtime happens.

Strategy #5: Confirm Order Within 1 Hour

Bank transfer requires customers to either login to their respective online bank or walk to the nearest Automated Teller Machine (ATM) to perform payment.

Our team is trained to respond with speed and efficiency to payments made into our any of our 6 bank accounts. We confirm orders within one hour after payments are credited. At times, we confirm orders within 5 minutes of payment and impressed our client with a bang!

Wow-factor experience to customers is an important key in this because it ensures confidence in future bank transfer payments.

If done right, you will not only have repeats in bank transfer orders, your client will spread your name to the world as well!

Strategy #6: It’s OK to Pay by Credit Card or PayPal

The number one obstacle for new clients to pay by bank transfer is trust. Some new clients are willing to pay by credit card due to the chargeback protection.

This is natural, so instead of hard selling the new client to pay by bank transfer, it is ok to encourage them to first pay by credit card. Trust (and future business!) will be earned once we deliver as advertised.

Once trust is earned, the client will return with new orders – and opt for bank transfer with confidence.

Everything in One Paragraph

Reward your clients with rebates when they choose to pay by bank transfer. Show them visuals on potential savings they can get with bank transfer. Share with them, the disadvantages of credit card processing fee. Offer convenience with wide bank coverage for them to perform payment. Impress clients with effective operation. Build trust by encouraging new clients to pay with options they are most comfortable with.

We did just that and scored 96.52% payments using bank transfer.

This article is written by KH Lau, Founder and CEO of Rolling Silver Holdings Sdn Bhd

COMMENTS